Rent Receipts/Slips: What is It, Format & How to Fill House Rent Receipt?

House Rent Allowance (HRA) is an allowance (part of CTC) given by your employer to help you cover the cost of living in a rented accommodation. However, due to a lack of experience or understanding of how the salary structure works, many are not fully aware of how to utilize this allowance.

If you live on rent and have made rent payments, you can claim a deduction on the House Rent Allowance at the time of filing your return. Rent receipts play a crucial role in enabling salaried individuals to claim deductions when filing their income tax returns. Read more in the below excerpt.

Contents

- What is Rent Receipt and Why is It Required?

- What amount of HRA is tax-free?

- What is the format of Rent Receipt?

- How to generate Rent Receipt online?

- Is it necessary to affix a revenue stamp on rent receipt?

- Why am I required to submit rent receipts to the HR Department?

- Important things to note about the rent receipts

- What are Fake Rent Receipts?

- Penalty for Fake Rent Receipts

- How does the payment of rent help you in saving taxes?

- How to claim an HRA exemption at the time of filing the ITR?

- How to ensure HRA does not get rejected

- FAQs about Rent Receipt

What is Rent Receipt and Why is It Required?

A rent receipt is a document provided by a landlord to a tenant acknowledging the payment of rent. It typically includes details such as the amount paid, the date of payment, the duration covered by the payment (e.g., month or week), the name of the tenant, and the signature or stamp of the landlord or property manager. Rent receipts serve as proof of payment and are important for both landlords and tenants to maintain accurate financial records.

To claim a House rent allowance (HRA), it is necessary to provide evidence of the payment of the rent to the employer; rent receipts work as evidence. The employer can provide deductions and allowances after verifying the same. The HRA allowance is based on the rent receipts and will be calculated accordingly.

Claim HRA deduction and minimize your tax burden by filing ITR. File ITR for FY 2023-24 (AY 2024-25) today.

What amount of HRA is tax-free?

You can claim exemption on some part of your HRA as per Section 10 (13A) of the IT Act. The deduction you can claim is the minimum of:

- Actual HRA received

- 50% of salary if you live in a Metro city

- 40% of salary if you live in any other city

- The actual rent you pay minus 10% of your annual salary

What is the format of Rent Receipt?

The transaction of rent happens between tenant & landlord on a certain date each month for a premise having an address and rent of xxx amount for the period of a month

So, for each rent receipt to be valid, the following mandatory elements must be present in a rent receipt:

- Tenant Name (If you are the tenant, fill in your name)

- Landlord Name

- Amount of Payment

- Date of Payment and mode of payment

- Rental Period

- House Address (Rented Property)

- Signature of Landlord or Manager

- Signature of Tenant

Other elements that are part of rent receipts:

PAN of the Landlord(not mandatory; mention only if annual rent exceeds Rs.1,00,000 in a year)

Revenue Stamp(where an amount exceeding Rs. 5000 is paid in cash)

- Method of payment (cash, credit card, money order, cashier’s check)

- Services or other fees included in the payment (e.g., utilities, security deposits, convenience fees)

How to generate Rent Receipt online?

You can use Tax2win’s Free Rent Receipt Generator to instantly generate your online rent receipts at any time.

Here is how you can generate rent receipts through Tax2win:

To use the Tax2win rent receipt generator, either you can click on the above link directly, or you can visit Tax2win and top of the home page click on the Tools, and you will find the Rent receipt Generator highlighted as shown in the image below:

Is it necessary to affix a revenue stamp on rent receipt?

A revenue stamp is required to be affixed on rent receipts if cash payment is more than Rs. 5000 per receipt. If rent is paid through cheque or online transfer, then a revenue stamp is not required.

You can easily understand it from the given table

| Mode of Payment | Whether revenue stamp is required |

|---|

| Cash, upto 5000 per receipt | No |

| Cash, more than 5000 per receipt | Yes |

| Cheque or online transfer | No |

Revenue stamps can be obtained from nearby post offices, or you can obtain the same by stationery shops, amazon, and local vendors.

Why am I required to submit rent receipts to the HR Department?

As per the Income Tax law of our country, every person who pays a salary is required to deduct tax at source(TDS), deposit with the government, and then pay the remaining amount to the employee. During this process, if any employee makes a tax-saving expenditure, then the person responsible for deducting tax has to consider and give the benefit of that expenditure and then deduct the tax on the net amount.

Practically, it has been observed that people submit fake rent receipts, even when they are not living in rented accommodation. So, to counter this, HR departments have started asking for rent agreements for giving HRA benefits.

Looking at the importance of rent agreements, here are 5 things to check in your rent agreement

Smart tactics to be followed at the time of drafting rent agreements-

- The rent agreement should be on a Rs. 500 stamp or as per the stamp rate prevailing in your state.

- It can be entered into for 11 months only.

- For more than 12 months, the rent agreement is not entered into; instead lease deed is to be preferred, which needs registration.

- Every year, the rent agreement is renewed after 11 months with the increased rent.

- Both landlord and tenant are required to serve the notice period as stated in the agreement.

Important Things to Note about the Rent Receipt

- If cash payment is more than Rs. 5000 per receipt, a revenue stamp must be affixed to rent receipts. If rent is paid through cheque, a revenue stamp is not required.

- The rent receipts for all the months for which you are claiming HRA is required to be submitted.

- If the annual rent paid exceeds Rs.1,00,000/—, the landlord's PAN must be reported to claim HRA exemption. If the landlord refuses to give his PAN, you cannot claim HRA for the rent paid in excess of Rs. 1,00,000/—, and your employer will deduct the TDS accordingly.

What are fake rent receipts?

Fake rent receipts are forged or falsified documents that falsely claim to represent payments made for rent. They are typically used for fraudulent purposes, such as:

- Tax Evasion: Individuals may use fake rent receipts to claim deductions on their income tax returns for rent payments that they did not actually make. This allows them to reduce their taxable income and pay less tax than they should.

- Tenant Verification: Some individuals may provide fake rent receipts when applying for a loan or other financial services to inflate their income and improve their eligibility.

- Landlord Fraud: In some cases, landlords may provide fake rent receipts to tenants to help them claim tax benefits or subsidies, or to deceive authorities about the actual rental income received.

While giving investment proof to the Income Tax Department, some people submit fake rent agreements and rent receipts to save more tax. If you are also thinking of doing something like this. Beware! As the Income Tax Department has started sending notices (IT Notices) to those who claim tax deduction by submitting fake rent receipts since last year.

Penalty for Fake Rent Receipts

The penalty for submitting fake rent receipts can vary depending on the jurisdiction and the severity of the offense. Civil Penalties: This could involve being sued by the landlord or property management company for damages, including the unpaid rent or any financial losses incurred due to the fraudulent activity.

- Criminal Charges: Falsifying documents, including rent receipts, may be considered a criminal offense. If convicted, the individual could face fines, probation, community service, or even imprisonment depending on the severity of the fraud and local laws.

- Tax Penalties: If the fake receipts are used to claim deductions on taxes, the individual may face penalties from tax authorities, including fines and interest on unpaid taxes.

- Reputation Damage: Being caught submitting fake rent receipts can damage a person's reputation, particularly if it involves a professional setting or business transaction. This could impact future rental opportunities, employment prospects, or relationships with financial institutions.

Received an Income Tax Notice for incorrect information added while filing the ITR; contact the tax2win experts for help responding to the ITD.

How does the payment of rent help you in saving taxes?

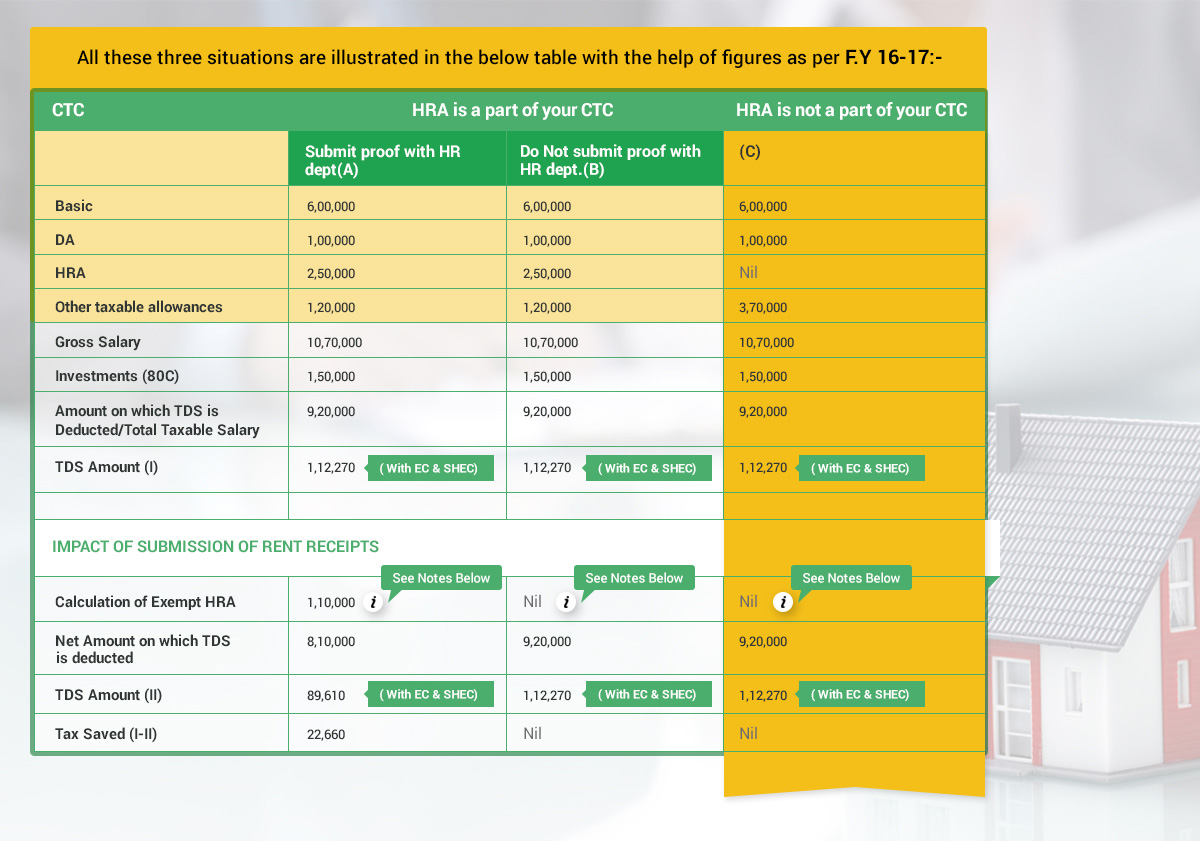

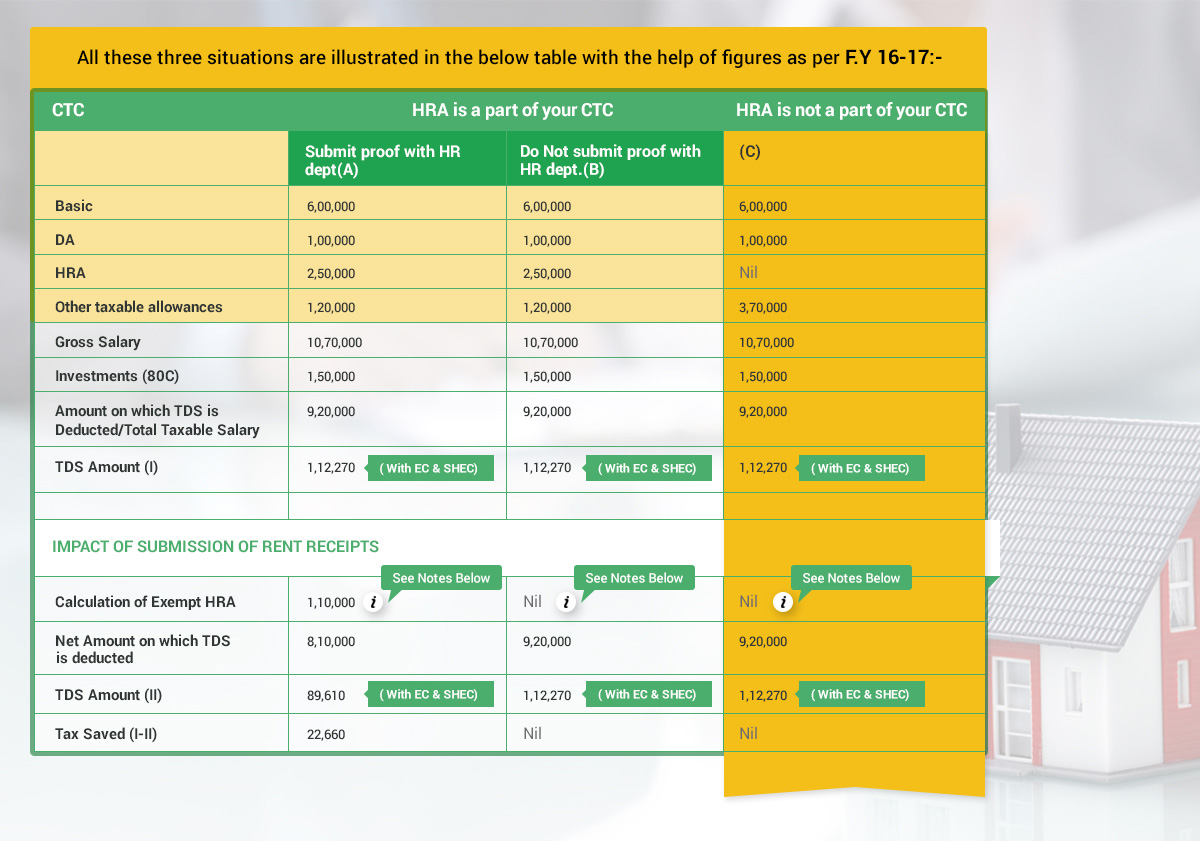

There can be three situations when you are paying rent for the rented accommodation -

- When HRA is a part of your CTC & you submit the proof of rent payment to your HR

- When HRA is a part of your CTC & you forget to submit the proof of rent payment to your HR

- When HRA is not a part of your CTC

of rent helps you in saving taxes?" />

of rent helps you in saving taxes?" />

Condition A:

Calculation of exempted HRA (Rent Paid - 1,80,000/-):-

- A. Actual HRA received - 2,50,000/-

- B. Rent Paid- 10% of Basic +DA= =110000/-

- C. 50% of Basic + DA ( 700000*50%)= 350000/=

A, B, C whichever is lower is to be selected as exempted HRA.

Condition B :

You can still claim the tax benefit of HRA at the time of filing the return, as HRA is a part of your CTC. The only notional loss you will have to bear is more amount of TDS that will be deducted during the year.

Condition C :

If HRA is not a part of your CTC, don’t be disheartened. You can still claim the deduction of rent paid at the time of filing the return u/s 80GG but upto Rs. 60,000 only.

How to claim an HRA exemption at the time of filing the ITR?

Here is a step-by-step process for claiming HRA exemption-

Step 1:Calculate the HRA exemption amount as discussed above. To avoid the hassle, you can also use our HRA exemption calculator to find out the amount of exempt HRA at https://tax2win.in/tax-tools/hra-calculator

Step 2:Deduct the amount of exempt HRA from the Income Chargeable under the head salary [column 6 of your Form 16, Part B].

Step 3:Enter the amount calculated in Step 2 under Income From Salary /Pension. For instance, your Gross Salary from Form 16 is 8,00,000, and you have an HRA exemption of Rs. 1,20,000, So instead of showing Salary income Rs. 8,00,000/- in ITR1 fill it as 6,80,000/-.

How to ensure HRA does not get rejected

To ensure that your House Rent Allowance (HRA) claim is not rejected, you should take the following steps and provide the necessary supporting documents:

- Genuine Rent Payment: Ensure that you are actually paying rent for the accommodation claimed for HRA. To be eligible for HRA benefits, the rent should be paid to a landlord other than close relatives.

- Rent Receipts: Collect and preserve original rent receipts from your landlord. The receipts should contain details such as the landlord's name, address, rent amount, and the period for which the rent is paid. The landlord should also duly sign the receipts.

- Rent Agreement: If you have a rent agreement with your landlord, keep a copy of the agreement as proof of the tenancy.

- PAN of Landlord: If the total annual rent paid exceeds Rs. 1,00,000, provide the landlord's Permanent Account Number (PAN) to your employer. Not providing the PAN can lead to a rejection of the HRA claim.

- Actual Residency: Ensure that you are actually residing at the rented premises and not just obtaining rent receipts for tax-saving purposes.

- HRA Component in Salary: Make sure that your salary structure clearly mentions the HRA component separately.

- Form 12BB: SSubmit a statement of your house rent receipts to your employer in Form 12BB to claim HRA benefits. This is generally required while income tax e filing.

- Proof of Payment: If you are making rent payments in cash, maintain records such as bank statements or withdrawal slips to support the transactions.

- File ITR with Correct Details: When filing your income tax return (ITR), ensure that you correctly mention the HRA details in the appropriate section of the ITR form.

- Consistency in Information: To avoid discrepancies, ensure that the information provided in your tax return matches the details in the supporting documents.

- Timely Filing: File your income tax return on time, meeting the deadlines set by the tax authorities.

We hope this article helped you learn a lot about rent receipts and their significance in claiming HRA exemption. If you have already generated your rent receipts using tax2win’s rent receipt generator, it's time to file your income tax return with tax2win and get a seamless ITR filing experience.

of rent helps you in saving taxes?" />

of rent helps you in saving taxes?" />